We help families build strength, stability, and self-reliance through shelter.

State Housing Tax Credit Program Application

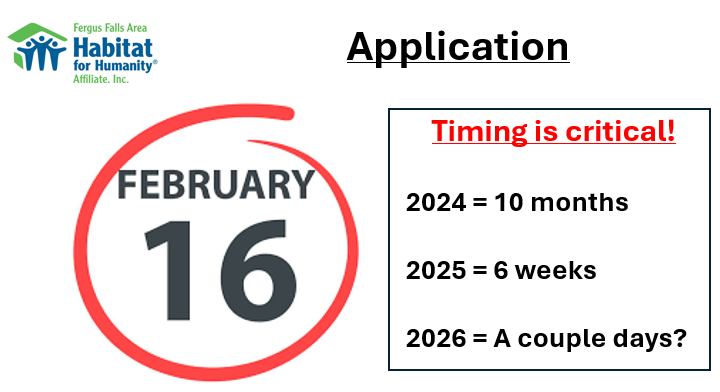

NOTE: This link will open for 2026 Donations on February 16th, 2026.

Information needed to complete the application and contribute to a Fergus Falls Area Habitat for Humanity qualified project:

1. After filling out your personal information and contribution amount, select “Specific Qualified Project” on the last step.

2. Choose one of the following projects to contribute to (type into the blank field)

Ottertail City - BLHS 2

Pelican Rapids - Viking Build

Fergus Falls - Springen 1

3. Type of project

a. Homeownership

4. Developer/Owner/Administrator Name

a. Fergus Falls Area Habitat for Humanity

5. Contact Telephone Number

a. 218-736-2905

6. Contact Email Address

a. fergushabitat@gmail.com

THANK YOU!

We had a successful 2025. We raised $257,400, nearly doubling contributions from 2024. This will significantly impact our housing production. Thank you to those who contributed in 2025!

2025 was a success!

We raised $257,400, nearly doubling contributions from 2024. This will significantly impact our housing production. Thank you to those who contributed in 2025! The State Housing Tax Credit is closed for 2025 but will be open again in February 2026.

Interested in being contacted when the program opens in 2026?

Click the button below and fill out the form and we will contact you then!

State Housing Tax Credit Program Application

Dave Sanderson ~ Personal Testimonial

Jeff Ackerson ~ Business Testimonial

The State Housing Tax Credit is closed for 2025. Here is the process that was used in 2025 and is expected to be used in 2026.

How do I contribute?

The 2025 contribution process is as follows:

Submit an online contribution application

Receive an email with payment instructions and documents to sign

Submit signed documents and contribution funds by the date provided in the email

Issued a tax credit certificate within 30 days of Minnesota Housing receiving the signed documents and funds

If your application is not accepted, you will be notified with the reason why your application was declined. 2025 state housing tax credits will be issued on a first-come, first-served basis. If a taxpayer submits a timely application and the requests for tax credits exceed the $9.9 million maximum, Minnesota Housing will notify the applicant and withdraw the application.